Disclosure: This post may include affiliate links, meaning we could earn a commission if you click and make a purchase based on our recommendation. See our Affiliate Disclosure here.

| DEX Aggregator | Description and Number of Token Pairs |

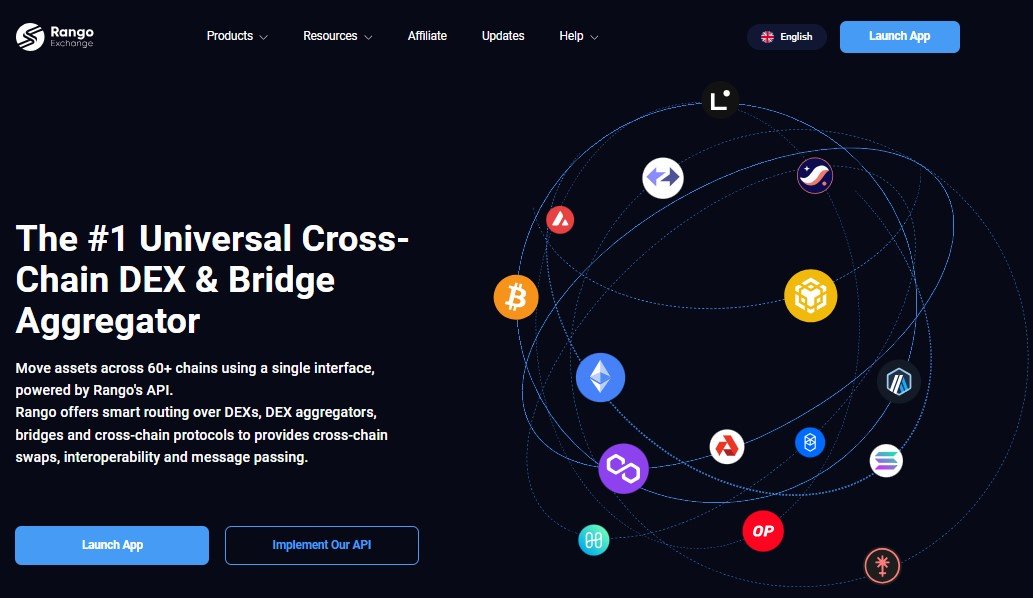

| Rango Exchange | Supports the largest range of token pairs, covering 42+ blockchains. |

| 1Inch | Offers 2,491 token pairs. |

| Jupiter | Aggregator for the Solana network. |

| ParaSwap | Has 144 token pairs available. |

| Open Ocean | Provides 88 token pairs. |

| Orion Protocol | Number of token pairs not specified. |

| Matcha | Number of token pairs not specified. |

Top DEX Aggregators to Explore

The crypto world is expanding rapidly, with new updates and regulatory moves happening almost daily. As centralized exchanges like Coinbase and Binance tighten their KYC (Know Your Customer) requirements, many users feel restricted in managing their funds freely. These growing policies could change the core of the crypto industry, which is all about decentralization and user control.

In contrast, Decentralized Exchanges (DEXs) offer a way to buy crypto assets while keeping control of your funds and staying anonymous. DEXs have become a trusted choice for many users seeking a secure and private way to trade cryptocurrencies. Explore our list of the best DEX options here!

While DEXs offer freedom, they can sometimes come with high transaction fees or slippage. With a new DEX launching almost every week, finding one with solid liquidity can also be challenging for investors.

This is where DEX aggregators come in handy. A DEX aggregator helps you find the best price for crypto, along with the lowest fees and minimal slippage, making trading smoother and more affordable.

Page Contents

- What Exactly Is a DEX Aggregator?

- Best DEX Aggregators for 2024

- Rango Exchange: Best Multi-Chain DEX Aggregator

- 1Inch Exchange

- Jupiter: Best DEX Aggregator on Solana

- ParaSwap

- OpenOcean

- Orion Protocol

- Matcha

- Conclusion: Best DEX Aggregator for 2024

- Help Us Improve: Was This Helpful?

What Exactly Is a DEX Aggregator?

Imagine platforms like Google Flights or Expedia, where you compare flight deals for the best price. A DEX aggregator works similarly, helping you find the best deal for buying or selling a crypto token. Essentially, it’s a search engine for decentralized exchanges (DEXs).

A DEX aggregator pulls liquidity from multiple DEXs to offer you a better price and lower fees than a single DEX could provide.

Below, we’ve compiled a list of the top DEX aggregators for 2024..

Best DEX Aggregators for 2024

To simplify your crypto experience, we’ve put together a list of the top DEX aggregators to help you make smarter trades in 2024.

With these DEX aggregators, you can find the best prices, cut down on fees, and ensure you’re getting the best rates on your crypto trades—no more searching for hours or paying more than necessary. Let’s dive in and discover how each of these DEX aggregators can help you optimize your trading strategy.

1. Rango Exchange – The Multi-Chain Marvel DEX Aggregator

If you’re looking for a reliable DEX aggregator, Rango Exchange is a great option to save. It pulls liquidity from many popular decentralized exchanges, like 1inch, to offer you the best rates.

What makes Rango.exchange special is its cross-chain swapping feature. This means you can exchange tokens between different blockchains, making it more flexible than most DEXs. It also works with all major wallets, so you can use it easily.

For anyone wanting an easy, no-KYC way to swap tokens, Rango Exchange lets you do it at the lowest cost while keeping full control over your funds.

2. 1Inch Exchange – The Leader in DEX Aggregation

1Inch Exchange has firmly positioned itself as the top DEX aggregator in the crypto industry. Sourcing liquidity from multiple DEXs and liquidity pools, it delivers deeper liquidity than any single DEX, ensuring you get the best deals and minimum slippage costs.

1Inch offers a massive selection of 2,491 crypto token pairs, giving you access to a wide variety of assets at the best prices. Additionally, if you’re looking to cut down on Ethereum gas fees, 1Inch provides an innovative solution with its native Chi Token, designed to lower transaction costs on the platform. The platform also offers a user-friendly mobile app, making it easier than ever to swap tokens directly from your smartphone.

One of the standout features of 1Inch is that it doesn’t charge any direct fees for buying, selling, or withdrawing funds. However, since it sources orders from different DEXs, you may incur individual trading fees from those specific exchanges.

In addition to standard trading, 1Inch allows you to engage in Yield Farming by supplying liquidity to its various pools, where you can earn returns on your assets while supporting decentralized finance.

Networks and Wallets Supported by 1Inch Exchange

1Inch Exchange currently operates across four major networks:

- Ethereum

- Binance Smart Chain

- Polygon

- Optimism

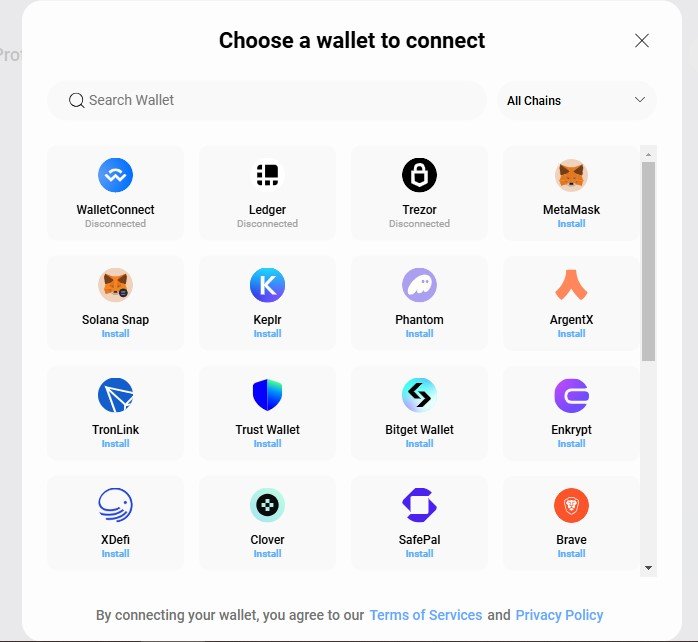

Beyond these networks, 1Inch supports a total of 16 wallets, including popular hardware wallets like Ledger and Trezor, ensuring your transactions are secure. This wide range of supported wallets makes it convenient and flexible for users to manage assets on the platform.

Moreover, 1Inch has its own governance token, called 1Inch, which allows users to participate in the platform’s decision-making through a DAO (Decentralized Autonomous Organization), giving you a voice in shaping the platform’s future.

For more detailed statistics on trading activity, you can explore 1Inch Exchange’s live data.

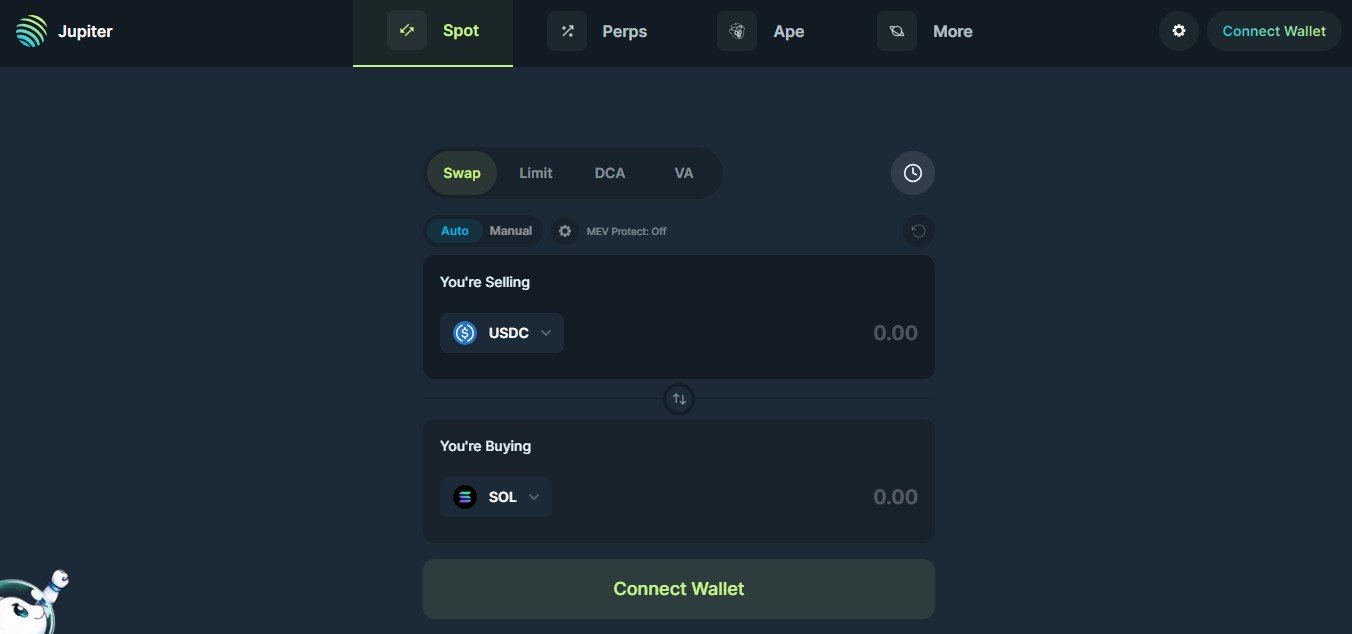

3. Jupiter – The Best DEX Aggregator on Solana

Jupiter stands out as the leading DEX aggregator on the Solana blockchain. By gathering liquidity from a range of Solana-based DEXs, including notable names like Orca and Raydium, Jupiter provides users with smooth access to some of the best prices and liquidity across the Solana ecosystem.

Jupiter brings a wave of innovation to the DEX landscape, setting itself apart with several advanced features designed for convenience and efficiency in trading.

Key Features of Jupiter DEX:

- Quick Swap: Easily exchange one token for another with fast and seamless swaps.

- Limit Orders: Set your preferred price for a token trade and let the platform execute it when the market meets your target.

- DCA (Dollar-Cost Averaging) Orders: Ideal for users looking to invest steadily over time, this feature allows for automated, gradual buys.

- Solana Bridge: Swap assets across chains and interact with various blockchain ecosystems directly through Solana.

- Perpetual Exchange: Trade crypto assets with perpetual contracts, opening new opportunities for leveraged trading.

Jupiter has also announced plans to launch its own token in January 2024, adding another layer of functionality and community involvement. With Solana activity growing rapidly, Jupiter seems poised to become the preferred DEX aggregator for users on the Solana network.

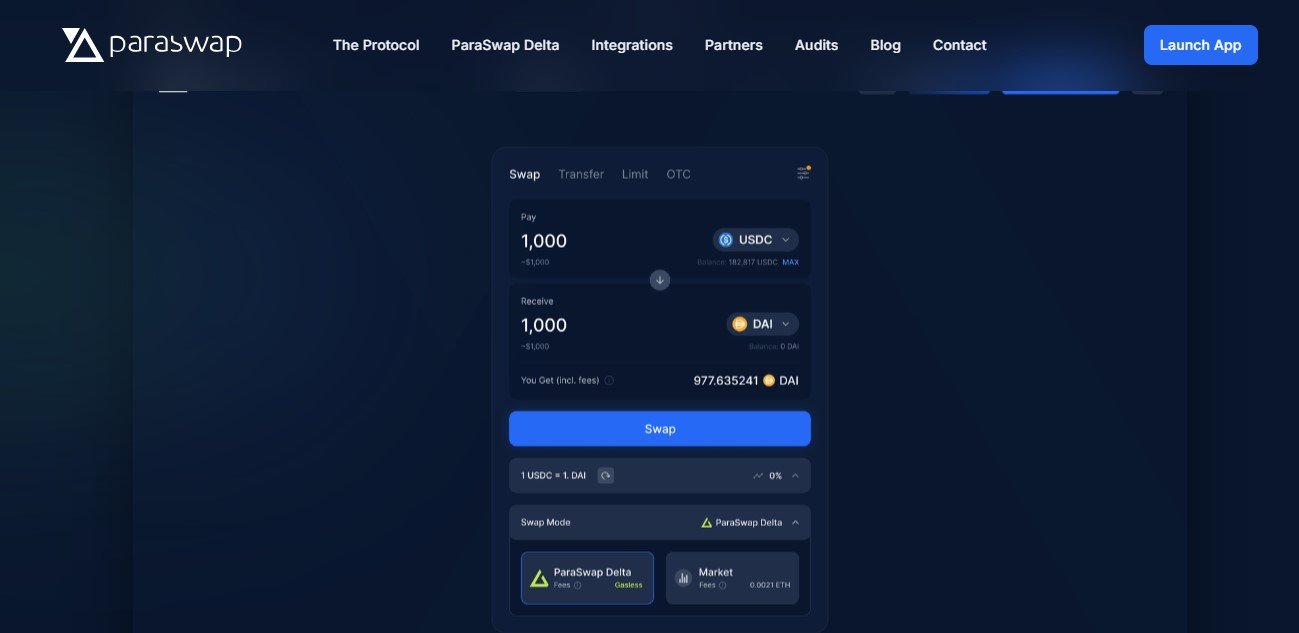

4. ParaSwap – The Fee-Free Option

ParaSwap is a prominent DEX aggregator, similar to 1Inch Exchange, that connects users to various liquidity pools and decentralized exchanges. In addition to sourcing liquidity from these platforms, ParaSwap features its own liquidity pool known as ParaSwapPool, enhancing its offerings.

One of the standout benefits of using ParaSwap is that it doesn’t impose any transaction fees for buying or selling crypto tokens. This means that when you trade through ParaSwap.io, you only need to pay the applicable gas fees for the network you’re using.

However, keep in mind that if you make a trade through a third-party service, such as an integrated wallet like Ledger, that service may charge additional fees.

ParaSwap offers a selection of 144 different crypto token pairs, allowing you to trade at competitive prices while minimizing slippage costs. This wide range makes it easier for users to find the best deals on their desired tokens.

Currently, ParaSwap operates across three major networks:

- Ethereum

- Binance Smart Chain

- Polygon

Supported Wallets

ParaSwap supports four different wallets, including the popular Ledger hardware wallet, ensuring a secure trading experience for users. For those using Ledger wallets, there’s an added convenience: ParaSwap is also compatible with the Ledger Live application, making transactions even smoother.

With its user-friendly interface and commitment to low fees, ParaSwap is a great choice for anyone looking to maximize their trading efficiency in the ever-evolving crypto market.

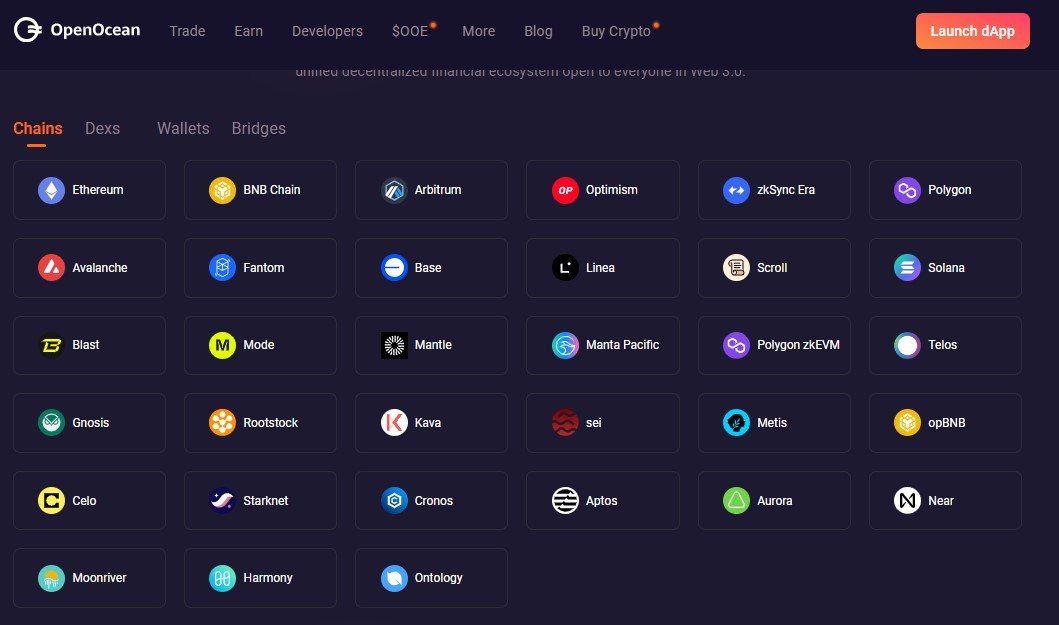

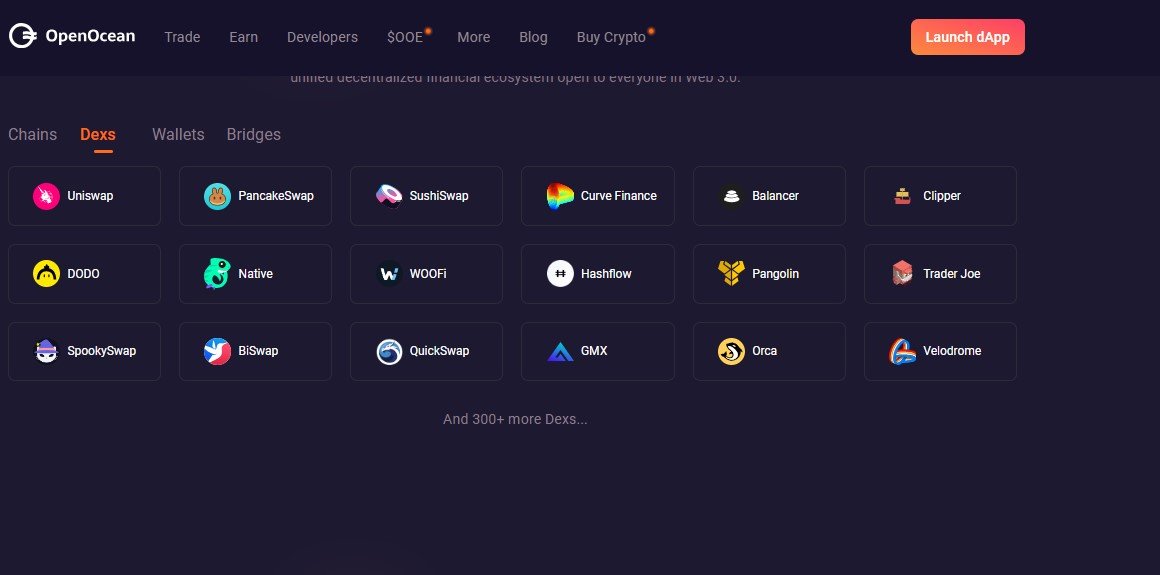

5. OpenOcean – The All-in-One DEX Aggregator

OpenOcean is pioneering the crypto landscape as the first comprehensive aggregator, sourcing liquidity from a wide range of decentralized exchanges (DEXs) and centralized exchanges (CEXs). This unique approach enables users to secure the best prices while minimizing slippage, making trading more efficient and cost-effective.

Notably, Binance was the first CEX to integrate with OpenOcean, solidifying its status as a complete market aggregator.

Versatile Trading and Investment Options

OpenOcean isn’t just about trading; it also offers features for Yield Farming, Lending, and Insurance, providing users with diverse opportunities to maximize their investments.

With 143 different crypto token pairs available, you can easily find competitive prices on your trades, ensuring you get the most value with the least slippage.

Supported Networks

OpenOcean currently supports an impressive nine networks:

- Ethereum

- Binance Smart Chain

- Ontology

- Tron

- Solana

- Polygon

- Heco

- OKExChain

- Avalanche

This extensive network compatibility enhances user flexibility and accessibility across various blockchain ecosystems.

In-House Token and Governance

The platform also features its own token, OOE, which plays a vital role in the governance of OpenOcean. Additionally, OOE can be utilized for liquidity mining, giving users an incentive to participate actively in the platform’s ecosystem.

With its innovative approach and broad range of functionalities, OpenOcean is setting new standards in the crypto market, making it an excellent choice for traders and investors alike.

6. Orion Protocol – Bridging DEXs and Centralized Exchanges

Orion Protocol operates similarly to OpenOcean, aiming to aggregate liquidity from all decentralized exchanges (DEXs) and centralized exchanges (CEXs) throughout the crypto universe. This approach enhances the overall liquidity of the platform, providing users with a seamless trading experience.

Trusted Brokers and Partnerships

The platform is backed by well-known brokers such as:

- Injective

- AscendEx

- KuCoin

- MEXC

These partnerships help bolster Orion Protocol’s reliability and expand its offerings within the crypto market.

Supported Networks

Currently, Orion Protocol operates on two major networks:

- Ethereum

- Binance Smart Chain

This network support allows users to access a wide range of tokens and trading opportunities across two of the most prominent blockchains.

Enhanced Security with Supported Wallets

Orion Protocol prioritizes transaction security by supporting four different wallets, including popular hardware options like Ledger and Trezor. This ensures that your assets remain safe while you trade.

Governance and Utility Token

The platform features its own governance token, ORN, which plays a critical role in managing the platform’s ecosystem. Users can utilize ORN tokens for various purposes, including staking and liquidity mining, offering a chance to earn rewards while participating in the governance of the platform.

For those interested in detailed trading metrics, you can access Orion Protocol’s trade statistics for insights into its market performance.

With its commitment to aggregating liquidity and providing a secure trading environment, Orion Protocol is an excellent option for anyone looking to navigate the diverse landscape of cryptocurrencies efficiently.

7. Matcha – Simple and Secure Trading

Matcha is a user-friendly DEX aggregator developed by 0x Labs, designed to help you find the best prices for crypto assets by sourcing liquidity from various platforms. Built on the Ethereum network, Matcha aims to provide a seamless trading experience.

Security You Can Trust

Safety is a top priority for Matcha. The platform operates using 0x v4 smart contracts, which have undergone rigorous auditing by ConsenSys Diligence, a leading name in the blockchain space. This auditing ensures that users can trade with confidence. For more details on the audit, you can check the results here.

Integrated DEXs

Matcha connects with a variety of DEXs, allowing you to access a wide range of trading options. You can refer to the comprehensive list of integrated DEXs here.

Supported Networks

Currently, Matcha supports three major networks:

- Ethereum

- Binance Smart Chain

- Polygon

This broad network compatibility enables users to explore diverse tokens and trading pairs across different blockchain ecosystems.

Compatible Wallets

To make trading even more convenient, Matcha is compatible with four different wallets. This feature allows users to choose their preferred wallet for added flexibility and security.

Fee Structure

Matcha operates with transparency regarding fees. The platform does not charge any additional fees beyond the network gas fee and any trading fees imposed by liquidity providers. This means you can focus on getting the best deals without worrying about hidden costs.

With its robust security measures, extensive network support, and commitment to user experience, Matcha is a fantastic choice for anyone looking to optimize their crypto trading strategy. Whether you’re a seasoned trader or just starting out, Matcha has the tools you need to navigate the world of decentralized finance effectively.

Conclusion – Choosing the Right DEX Aggregator for You

That wraps up our guide to the top DEX aggregators available in the market today! Utilizing a DEX aggregator gives you the advantage of maintaining full control over your funds while securing the best prices for your trades.

For optimal security, it’s highly recommended to use a hardware wallet like the Ledger Nano X or Trezor when engaging with a DEX aggregator. If you’re just beginning your crypto journey, platforms like 1Inch Exchange or ParaSwap are excellent starting points.

For an even smoother trading experience, especially if you’re using a Ledger wallet, consider using the Ledger Live application. This integration with ParaSwap can significantly enhance your transaction efficiency and ease.

We hope this post has helped you find a suitable DEX aggregator that meets your needs. If you have any questions or feedback, we’d love to hear from you! Feel free to share your thoughts in the comments section below. Happy trading!