Disclosure: This post may include affiliate links, meaning we could earn a commission if you click and make a purchase based on our recommendation. See our Affiliate Disclosure here.

What’s the Best Way to Stake Solana Tokens (SOL)?

What Are the Staking Rewards for Solana Tokens (SOL)?

How Many Solana Coins Do I Need to Stake?

Are you on the lookout for the top strategies to stake your Solana (SOL) tokens effectively? Look no further! This guide will dive into the most rewarding and secure ways to stake SOL, detailing the staking rewards and minimum SOL required for staking. We’ll compare popular methods so you can make an informed decision and start earning passive income with confidence. Get ready to learn everything you need to know about staking Solana and unlocking its earning potential!

Here’s a quick look at the top platforms to stake your SOL tokens and start maximizing your earnings. Dive into these trusted options to find the best fit for your Solana staking journey!

| S. No. | Platform | Minimum Deposit | Lock-in Period | Rewards APY |

| 1 | Binance | 0.0001 SOL | 30 Days – 90 Days | 9.28% – 13.21% |

| 2 | Phantom Wallet | 0.002281881 SOL | 4-5 Days | 5.00% – 6.28% |

Solana is a powerhouse among Layer 1 blockchain networks, supported by its native token, SOL. For long-term HODLers, staking SOL presents an enticing way to not only protect their investments but also earn consistent staking rewards over time, making it a smart choice for maximizing returns.

Staking SOL has several personal advantages that go beyond simply earning rewards. Here’s why I’d choose to stake my SOL:

- Combat SOL Inflation: With Solana’s inflation rate averaging around 6-8%, staking is an effective way to offset potential inflation impacts and maintain the value of my assets.

- Secure Long-Term Investments: Locking my SOL ensures I’m less likely to sell impulsively during market downturns, allowing me to remain steady with my long-term investment goals.

- Earn Additional Rewards: Staking provides a steady stream of rewards, adding value to my holdings without any active trading or risk.

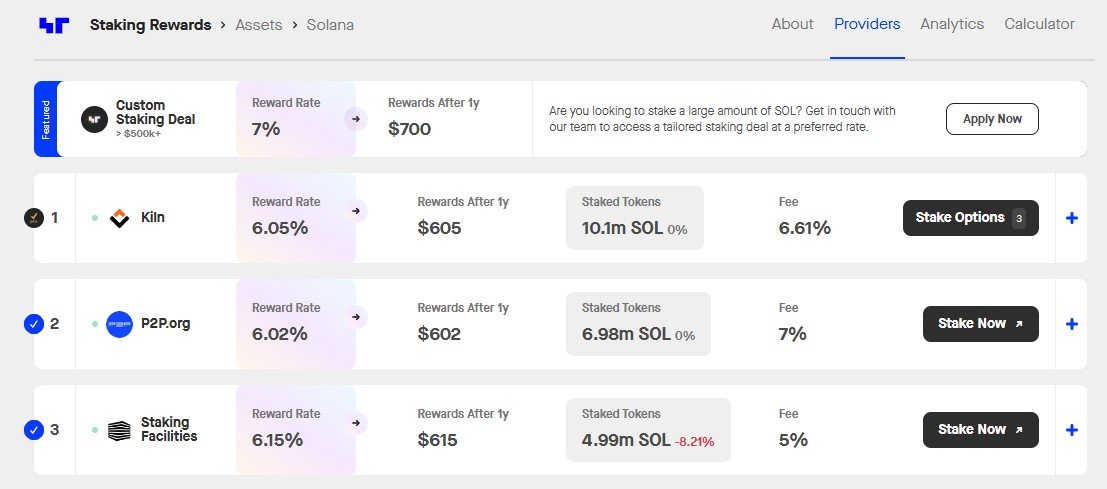

According to StakingRewards.com, Solana staking rewards currently range between 5-7% per annum, providing a reliable return for investors. However, with a few select strategies, it’s possible to secure even higher rewards, enhancing the profitability of staking SOL and making it an excellent choice for those seeking passive income.

Now, let’s dive into the top methods for staking SOL, exploring each option to help you make the most of your Solana investment.

Top Ways to Stake SOL Tokens

1. Binance

Binance, recognized as the largest cryptocurrency exchange globally in terms of user count and trading volume, provides an extensive range of staking services. Beyond trading, Binance offers Locked Staking, which is perfect for users wanting to earn rewards on their SOL holdings.

What is Binance Locked Staking for Solana (SOL)?

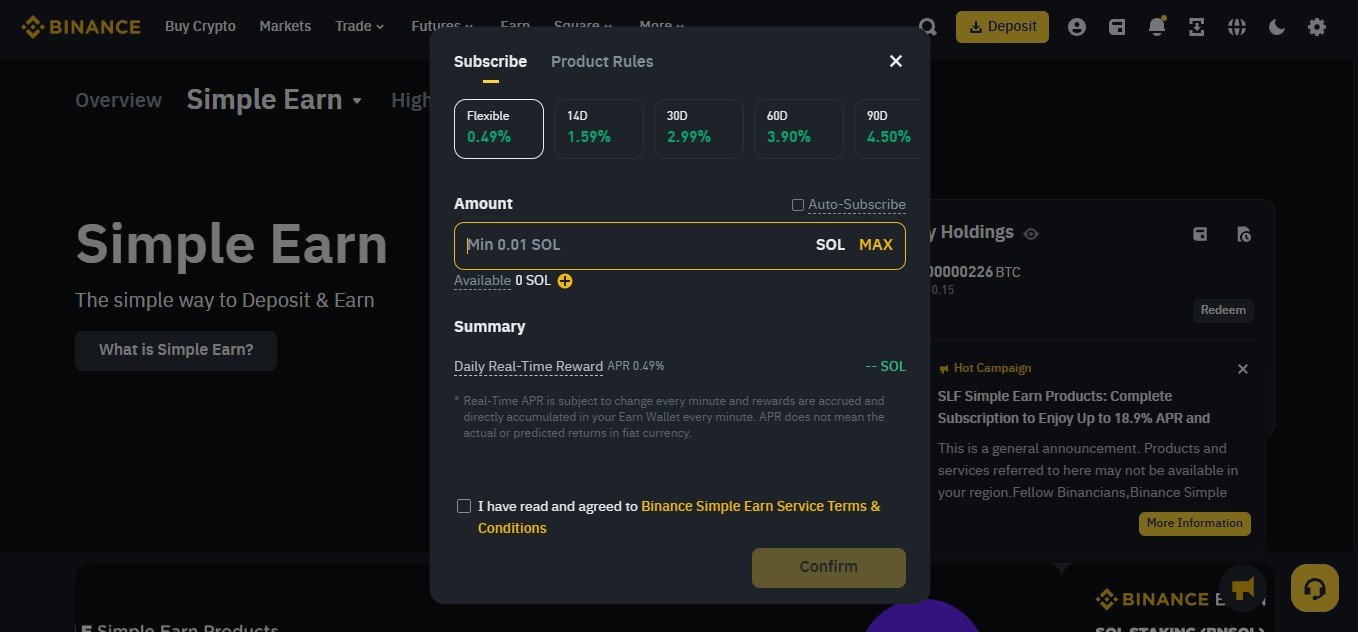

Binance’s Locked Staking program allows you to stake your SOL tokens for a specified period and earn a steady yield on your assets.

Staking Conditions for SOL on Binance

To begin staking SOL on Binance, consider the following:

- Lock-in Periods: Binance provides options to lock in your tokens for 30, 60, or 90 days. This flexibility makes it suitable for users who want a short-to-medium term staking solution.

- Minimum Staking Amount: The minimum staking requirement ranges between 0.0001 SOL to 0.01 SOL, depending on your selected lock-in duration. This low entry threshold makes it accessible for all levels of investors.

But why choose Binance over other staking platforms? Let’s explore the advantages Binance offers to SOL stakers.

Why Choose Binance for Staking SOL?

Binance offers a combination of high rewards, simplicity, and security, making it an appealing choice for staking SOL tokens. Here are some reasons why Binance could be the ideal platform for you:

- Medium-Term Staking Flexibility

If you are looking to stake for a moderate period of 1-3 months, Binance provides tailored lock-in options that let you choose the staking duration that aligns with your goals. - Competitive APY Rewards

Binance is known for offering some of the highest APYs on SOL staking, allowing you to maximize your earnings compared to other staking platforms. - User-Friendly Staking Process

The staking process on Binance is designed to be simple and quick, making it easy for both beginners and experienced users to get started without any hassle. - Industry-Leading Security

Binance prioritizes security, so users can feel confident that their funds are well-protected. With multiple security protocols, Binance offers peace of mind for investors staking their valuable assets.

Limitations of Staking SOL on Binance

While Binance’s Locked Staking service has significant benefits, there are a few limitations to keep in mind:

- Liquidity Limitations

Once staked, your SOL tokens are locked for the chosen duration (30, 60, or 90 days), meaning you won’t have immediate access to these funds until the period ends. If you need quick access to your assets, consider exploring Liquid Staking options, such as Lido Finance, which provides liquidity while still offering staking rewards. - Custodial Staking Risks

Binance is a custodial exchange, which means it holds custody of your staked assets. While Binance employs rigorous security protocols, custodial staking inherently carries some risk in the unlikely event of an exchange security breach.

Important Notes for Binance Locked Staking

With Binance’s Locked Staking, users should be aware of the following:

- Early Unstaking: Binance allows users to withdraw their assets before the end of the lock-in period. However, if you unstake early, Binance will reclaim all rewards earned during that time. Therefore, upon early withdrawal, you’ll receive:

Total Amount Staked – Distributed Staking Rewards

It’s important to consider this if you think you might need access to your SOL before the staking period ends.

How to Stake SOL on Binance: Step-by-Step Guide

If you’re ready to stake SOL tokens on Binance, follow these simple steps:

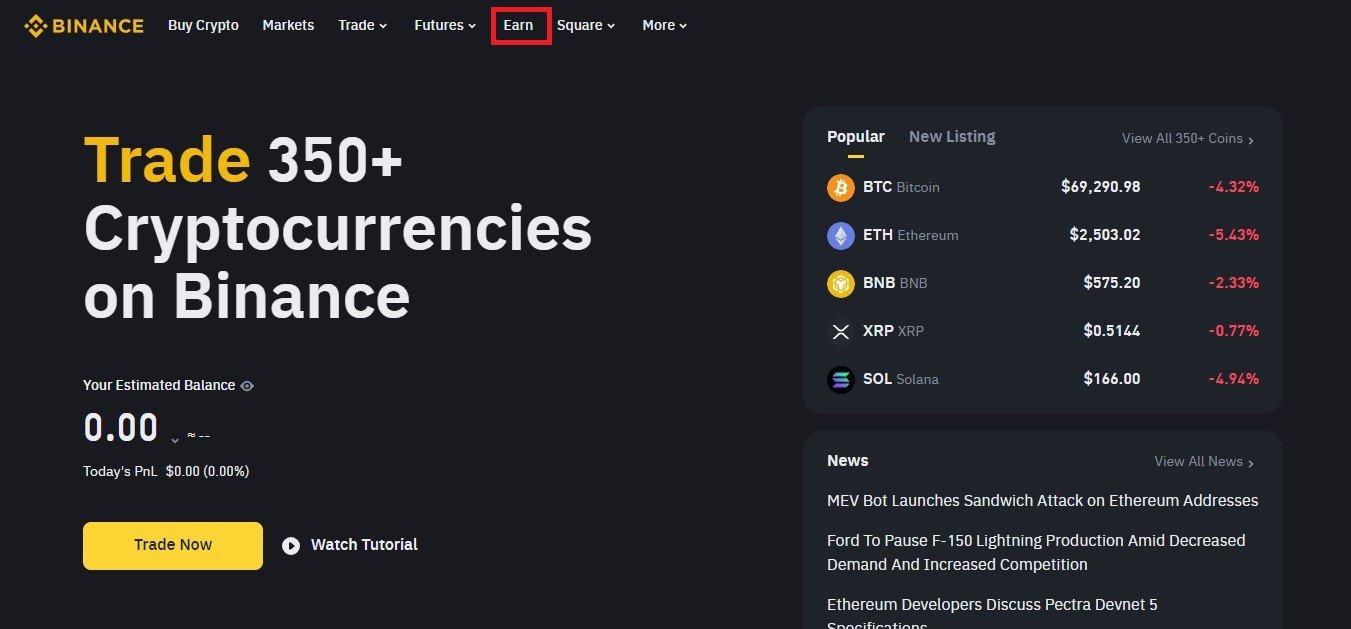

Step 1: Navigate to Binance Earn

Log in to your Binance account and go to the “Earn” tab on the homepage. Select “Staking” from the dropdown menu.

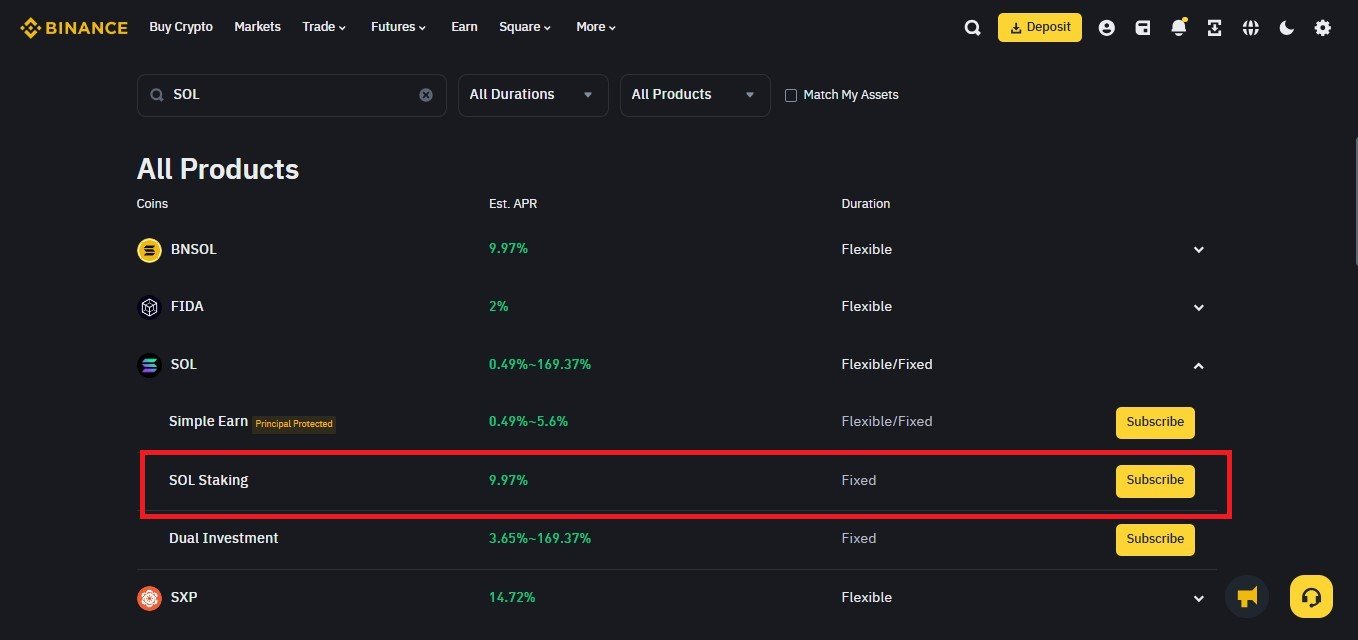

Step 2: Select SOL from Locked Staking Options

In the “Locked Staking” section, type “SOL” in the search bar to find Solana staking options. You will see different options based on the lock-in periods available. Choose between 30, 60, or 90 days, depending on your preference.

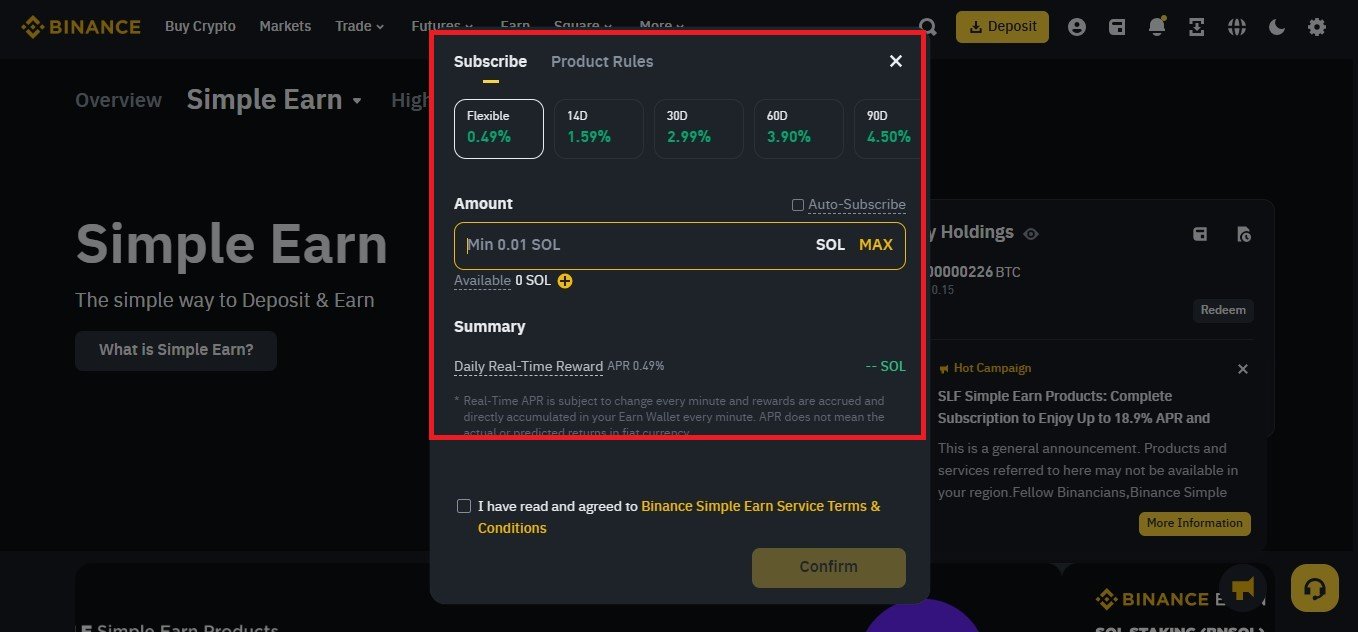

Step 3: Enter Your Desired Staking Amount

Input the amount of SOL you’d like to stake. Be sure to meet the minimum staking requirements, which vary with each lock-in period. Agree to the “Binance Staking Service Agreement” and click “Confirm” to complete the staking process.

Step 4: Check Your Staked Assets

To view your staked SOL tokens, go to “Wallet,” select “Earn,” and click on “Staking.” You’ll be able to see your staked assets, track your earnings, and monitor your lock-in period status here.

By following these steps, you can efficiently stake your SOL on Binance and start enjoying passive income with minimal effort. This method provides a straightforward way to grow your Solana holdings while securing them in a trusted exchange.

2. Phantom Wallet

Phantom Wallet is a decentralized, non-custodial wallet tailored for the Solana blockchain, offering full control and security over your assets. Unlike Binance’s custodial solution, Phantom is designed for users who prioritize holding their private keys. Much like MetaMask but built for Solana, Phantom ensures that your keys are stored locally on your device. With compatibility across popular browsers like Chrome, Brave, Firefox, and Edge, as well as integration with Ledger hardware wallets, Phantom is an ideal option for secure SOL staking.

Key Conditions for Staking SOL on Phantom Wallet

Before diving into the staking process, consider the following staking conditions on Phantom Wallet:

- Minimum Staking Amount: You’ll need a minimum of 0.002281881 SOL to get started, making it an accessible option for even small-scale investors.

- Rewards Rate: Phantom offers annual staking rewards ranging from 5.00% to 6.28%, allowing for steady earnings on your SOL holdings.

- No Long Lock-in Period: Phantom doesn’t impose strict lock-in periods, and typically, staking activation takes 4-5 days. After activation, your SOL tokens will continue earning without needing to be re-locked.

- Network Fees: Like other Solana transactions, a minimal network fee applies during staking and unstaking, covering operational costs.

When to Choose Phantom Wallet for Staking SOL

Phantom Wallet is well-suited for users who prioritize:

- Full Custody Over Funds: Since Phantom is non-custodial, you have complete ownership of your assets, ensuring that no third party holds your private keys or controls your SOL.

- Long-Term Staking: Phantom is optimal for users planning to stake SOL over an extended period, benefiting from its security and non-custodial setup.

While Phantom Wallet offers unique advantages, there are a few aspects to consider before staking.

Limitations of Staking SOL on Phantom Wallet

- No Immediate Liquidity

Once staked, your SOL tokens are effectively locked, meaning you won’t have instant liquidity. For those seeking liquidity, Lido Finance offers liquid staking on Solana, providing derivative tokens you can trade while still earning staking rewards. - Complexity

Staking SOL on Phantom Wallet involves a few more steps compared to Binance, which may be less convenient for newcomers. - Network Fees

Although small, Solana’s network fees are part of the staking and unstaking processes on Phantom Wallet, which may slightly affect overall returns. - Lower Reward Rates

Phantom generally provides slightly lower APYs compared to platforms like Binance, which could be a consideration for users aiming for maximum returns.

Step-by-Step Guide to Staking SOL on Phantom Wallet

Ready to stake SOL with Phantom? Here’s a step-by-step walkthrough:

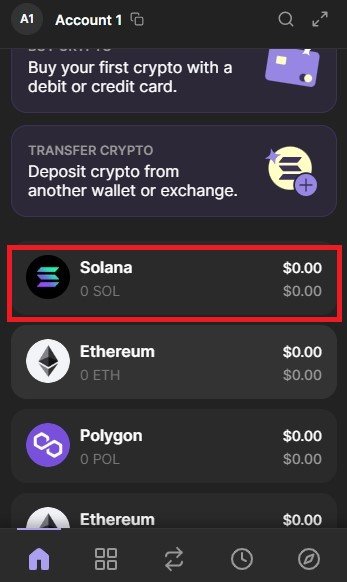

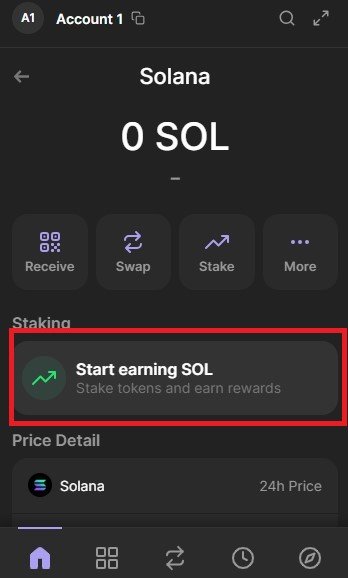

Step 1: Access the SOL Tokens Section

Open your Phantom Wallet app or extension, and click on the “Solana Tokens” tab to view your SOL holdings.

Step 2: Initiate Staking

Select “Start Earning SOL” to open the staking options. This will allow you to begin the staking process directly from your wallet.

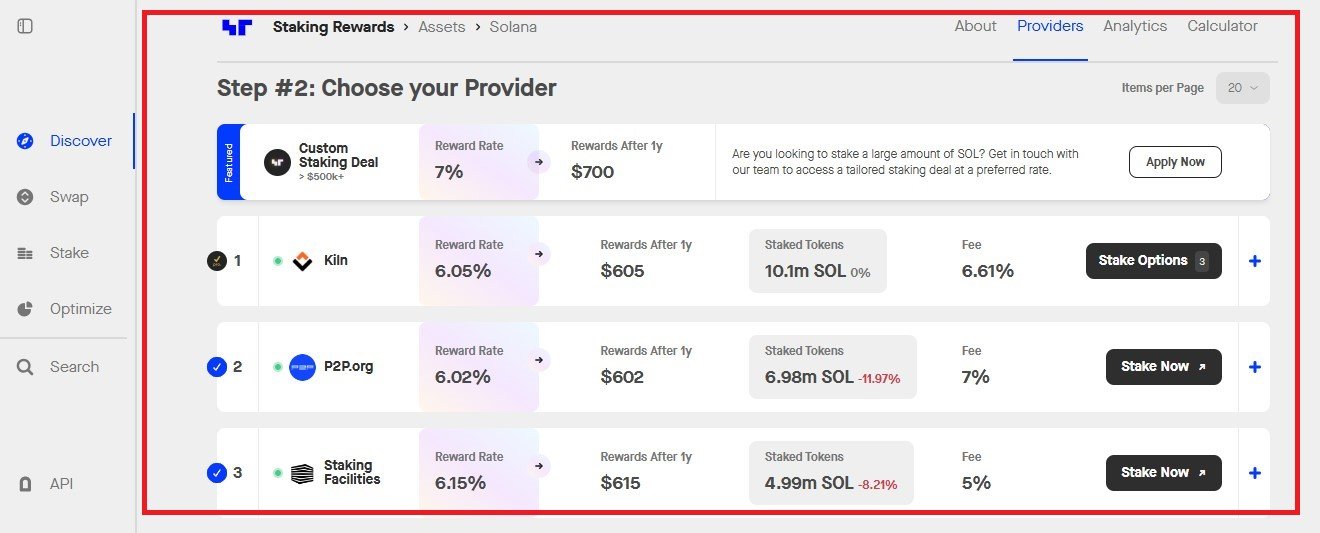

Step 3: Select a Validator on StakingRewards.com

For optimal staking results, visit StakingRewards.com to browse a list of trusted Solana validators. Look for validators with high user numbers and significant staked balances, which can indicate reliability.

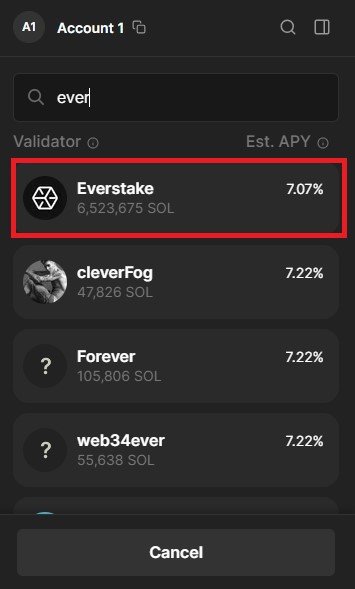

Step 4: Choose Your Validator in Phantom Wallet

Once you’ve selected a validator from StakingRewards.com, return to Phantom Wallet and choose that validator within the staking interface.

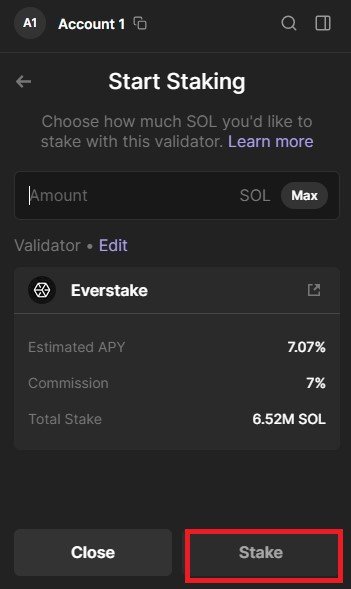

Step 5: Enter the Staking Amount

Specify the amount of SOL you want to stake and confirm by clicking on “Stake.” Ensure you meet the minimum staking amount and verify that you’re satisfied with your chosen validator.

Step 6: Check Your Staking Status

After staking, you can view your staked tokens by navigating to the staking section within Phantom Wallet. Here, you’ll see your tokens with an “Activating” status, which typically takes 4-5 days to switch to “Active.”

Phantom Wallet provides a secure, user-controlled option for staking SOL tokens, making it ideal for those who want full control over their assets and a long-term staking solution. Whether you’re new to staking or a seasoned crypto enthusiast, Phantom Wallet offers a straightforward yet powerful tool to grow your Solana investments.

Conclusion: How to Stake Solana (SOL) Tokens

In summary, there are four effective methods to stake your Solana (SOL) tokens, each catering to different user needs and preferences. If you’re just starting your journey in cryptocurrency, Binance offers a user-friendly platform that’s perfect for beginners. It simplifies the staking process, making it easy for you to earn rewards without diving deep into technical complexities.

On the other hand, if you value decentralization and wish to maintain self-custody of your assets, platforms like Phantom Wallet are excellent choices. They empower you to control your funds while offering the added benefit of liquidity through derivative tokens. This approach not only enhances your earning potential but also aligns with the core principles of the crypto ethos.

We hope this guide has provided you with valuable insights into staking Solana tokens. If you have specific tokens in mind for which you’d like us to create similar staking guides, please let us know! Your feedback helps us deliver the content you find most useful. Happy staking!