Disclosure: This post may include affiliate links, meaning we could earn a commission if you click and make a purchase based on our recommendation. See our Affiliate Disclosure here.

|

The Top No KYC Crypto Exchanges Ranked |

||

| Non-KYC exchanges | Description | No KYC Withdrawal Limit |

| BingX (Popular No KYC Exchange) | BingX offers spot, P2P, and derivatives trading. | BingX offers spot, P2P, and derivatives trading. |

| Toobit | Toobit offers futures, spot trading, & over-the-counter trading. | 5 BTC |

| LBANK | An established crypto exchange with a lot of crypto pairs and an extremely high withdrawal limit for non-KYC users. | 280000 USDT/Daily |

| GMX Exchange (Decentralized No ID exchange) | A perpetual contract trading platform for top cryptocurrencies. | Unlimited |

| ApeX Pro | No KYC crypto derivative DEX with 30X Leverage | No KYC needed |

| Phemex (Editor’s choice) | If you are looking for a higher withdrawal limit with No KYC, Phemex currently supports that. | 50000 USDT/Day |

| MEXC (Growing Fast) | Top volume exchange that does not require KYC unless you want to withdraw more than 2 BTC in 24 hours. | 2 BTC/Daily |

| 1Inchexchange | A DEX aggregator that can be used to exchange any amount of ERC20 and supports multiple blockchain. | No limit |

| Changelly | Another popular crypto swap platform that does not require KYC. | 2 BTC/24h |

| Thorswap | Thorswap is powered by Thorchain. | No limit |

| Bisq | BitSquare is a P2P marketplace for cryptocurrencies. | No limit |

Are you interested in purchasing altcoins without the hassle of answering endless questions? Are you tired of repeating the KYC process on different crypto exchanges? If you’re looking for ways to bypass the tedious KYC and AML procedures, you’re in the right place.

In this guide, I’ll introduce you to several altcoin exchanges that allow you to trade without undergoing KYC and AML checks. Plus, many of these platforms don’t impose any limits on withdrawals or deposits, giving you the freedom to buy and sell as much as you want.

As the market for decentralized exchanges grows, these no-KYC options may become the standard. However, this shift could take some time.

Important Note: Keep in mind that laws regarding identity verification for crypto exchanges vary by location. It’s essential to check your local regulations before using any foreign exchange that doesn’t require KYC. You are solely responsible for adhering to all relevant laws while trading cryptocurrencies. This information is for general guidance only and should not be considered legal or financial advice.

Pro Tip: To enhance your privacy, consider creating a new email account with a provider like ProtonMail, which doesn’t track your activities. Additionally, using a no-logs VPN can help you access these no-KYC exchanges more discreetly.

For now, we can take advantage of these services—some centralized and others decentralized—to bypass KYC and AML checks while safeguarding your privacy.

12 No KYC Exchanges for Crypto

1. BingX – Withdraw Up to 50,000 USDT Daily Without KYC

BingX, established in 2018, has quickly gained popularity as a no-KYC crypto exchange, allowing users to withdraw up to 50,000 USDT daily without completing KYC verification.

Here’s a closer look at BingX’s standout features:

- Spot and Derivative Trading: Offers diverse trading options, including both spot and derivatives markets.

- Welcome Bonus of Up to 5,125 USDT: New users can claim a generous bonus, adding extra value to your initial trading experience.

- International Presence: BingX has offices in Canada, the EU, and Australia, offering broad accessibility for global users.

- Full Proof of Reserves: Users can feel secure with BingX’s commitment to transparent asset reserves.

- Peer-to-Peer (P2P) Marketplace: Trade directly with other users through the P2P platform, enhancing privacy and flexibility.

- Grid Bot Trading: Automate your trades and leverage BingX’s advanced grid bot tool to execute strategies.

If you require a daily withdrawal limit higher than 50,000 USDT, you’ll need to complete KYC verification. For more details, be sure to review BingX’s KYC guidelines.

2. Toobit – Low Fees and No KYC for Crypto Trading

With leading exchanges like KuCoin and Bybit enforcing mandatory KYC (Know Your Customer) requirements, newer centralized exchanges are emerging with more relaxed KYC policies. If you’re in search of a trading platform without KYC requirements, Toobit could be a worthwhile choice.

Toobit allows users to buy crypto without KYC verification on the platform itself. However, keep in mind that the payment provider may request verification depending on the payment method you select.

Here are some notable features of Toobit for non-KYC users:

- Daily Withdrawal Limit of 5 BTC: Withdraw up to 5 BTC per day without undergoing KYC.

- Trade Crypto Anonymously: Enjoy trading digital assets without KYC verification.

- Basic Verification for Fiat Purchases: For buying crypto with fiat, basic verification may be required.

- User-Friendly Mobile App: The Toobit app provides an efficient and convenient way to trade on the go.

Toobit’s team includes experienced professionals from Bybit, Huobi, and Xiaomi, making it a reliable choice for those seeking a no-KYC crypto exchange.

3. LBANK – Trade Crypto Without KYC

LBANK is a no-KYC crypto exchange offering a high daily withdrawal limit and a user-friendly interface. With a range of features that rival top-tier exchanges, LBANK provides options like spot trading, futures trading, grid bots, and earning programs to suit different trading styles.

One of LBANK’s standout qualities is its rapid listing of new cryptocurrencies, making it a go-to platform for traders and investors seeking variety. However, it’s often best to use limit orders on LBANK, as liquidity depth may sometimes vary.

For those aiming to trade without KYC, LBANK is a strong choice.

LBANK Daily Withdrawal Limit:

LBANK allows users to withdraw up to 280,000 USDT or its crypto equivalent every 24 hours without needing a KYC account.

4. GMX Exchange – Non-KYC Decentralized Perpetual Exchange

After the FTX collapse in 2022, many traders began prioritizing self-custody and shifted to decentralized exchanges. GMX Exchange is a non-KYC DEX (Decentralized Exchange) that lets you trade freely without verification requirements or permission.

To trade on GMX, you’ll need a good understanding of self-custodial wallets like MetaMask or Trust Wallet. If you’re new to these wallets, it’s wise to learn about them first or stick to other centralized no-KYC exchanges until you’re comfortable.

Key Features of GMX Exchange:

- Available on Arbitrum and Avalanche: GMX operates on these popular blockchain networks, giving users access to fast, low-fee trading.

- Decentralized Perpetual Exchange: Trade perpetual contracts without intermediaries.

- Wide Range of Tokens: Supports major tokens like ETH, WBTC (Bitcoin), LINK, UNI, USDT, DAI, and others.

Also, consider using a GMX referral code to save on trading fees and enjoy lifelong discounts.

5. ApeX Pro – No-KYC Decentralized Exchange (DEX)

ApeX Pro is an innovative decentralized derivatives exchange that empowers traders by providing full control over their funds and data. Here’s what makes ApeX Pro unique.

Key Features of ApeX Pro

- No KYC Requirements: ApeX Pro enables users to trade without any invasive KYC checks or the need for identification documents. Simply connect your wallet and trade anonymously in a completely permissionless environment.

- Non-Custodial Trading: As a fully decentralized platform, ApeX Pro does not hold your funds. Your assets remain secure in your wallet, giving you total control over your funds while you trade.

- No VPN Needed: ApeX Pro’s decentralized nature allows traders from most locations to access the platform without a VPN, as there are no IP restrictions in place.

- Advanced Trading Tools: Offering up to 30x leverage, cross-margining across assets, and instant trade settlement, ApeX Pro delivers a robust trading experience for all users.

- Multi-Chain Compatibility: ApeX Pro is designed to integrate with top layer 1 and layer 2 blockchains, ensuring smooth trading across different networks.

- Social Trading Options: With planned social trading features, ApeX Pro allows users to follow and execute strategies from top-performing traders on the platform.

Summary

ApeX Pro offers a privacy-first approach to decentralized derivatives trading, eliminating KYC requirements and third-party custody of funds while delivering powerful trading features. For traders who prioritize privacy, anonymity, and control over their assets, ApeX Pro is becoming a top choice for trading perpetual crypto contracts. This platform allows you to trade freely, without identity checks or regional limitations.

6. Phemex – Anonymous Crypto Trading Option

Phemex, based in Singapore, has become a popular choice for traders seeking no-KYC options after exchanges like KuCoin and Bybit implemented mandatory KYC.

On Phemex, you only need to complete KYC if you plan to withdraw funds in USD. For those trading solely in cryptocurrencies, Phemex allows you to maintain a non-KYC account with a daily withdrawal limit of 50,000 USDT or its equivalent in other cryptocurrencies.

Key Features of Phemex

- Competitive Fees: Offers low trading fees and discounts for high-volume traders.

- Diverse Crypto Options: Provides access to a wide selection of cryptocurrencies.

- Advanced Trading Capabilities: Includes features like leverage and derivatives trading.

- High Liquidity: Ensures ample liquidity for popular trading pairs.

- Robust Security: Boasts excellent security protocols to keep funds safe.

- Efficient Customer Support: Responsive support team available for assistance.

- User-Friendly Mobile App: Allows you to trade on the go with ease.

For a more comprehensive review of Phemex, check out the detailed guide and sign up to receive a welcome bonus.

7. MEXC – High-Limit No-KYC Exchange

MEXC has built a large user base over the years, attracting traders with its robust features and lenient KYC policies. As a non-KYC user on MEXC, you can withdraw up to 30 BTC daily. Completing basic KYC increases this limit to 80 BTC or more.

MEXC provides multiple trading options for investors and traders alike. For more details on the platform, consider checking out a comprehensive MEXC review.

Why MEXC Is Popular:

- Affordable Trading Fees: Enjoy low trading fees across the board.

- Generous Withdrawal Limits: Non-KYC accounts can withdraw up to 30 BTC daily.

- Diverse Trading Options: Offers both spot and derivative trading.

- Native Exchange Token: Use MEXC’s token to further reduce trading fees.

- Modern Mobile App: Trade easily from your smartphone.

- Leverage up to 200X: Access high leverage for more dynamic trading strategies.

MEXC’s flexible KYC options and high withdrawal limits make it an attractive choice for traders looking for freedom and flexibility.

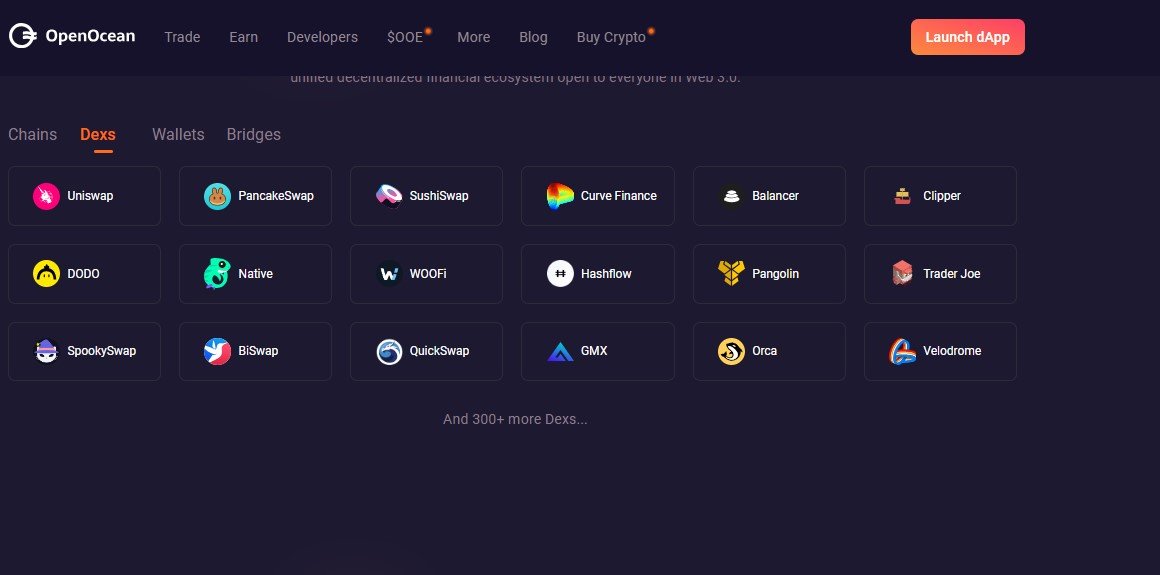

8. 1Inch Exchange – Non-KYC DEX Aggregator for ERC20 Tokens

1Inch Exchange is one of the most popular platforms for trading ERC20 tokens without any KYC requirements. Acting as a decentralized exchange (DEX) aggregator, 1Inch scans multiple DEXs—such as Uniswap, SushiSwap, and Balancer—to provide users with the best available trading rates across these platforms.

For those who prioritize privacy, 1Inch offers an easy and efficient trading experience. You can start trading on 1Inch by connecting a self-custodial wallet like MetaMask or any other compatible crypto wallet. This lets you maintain full control over your funds and trade anonymously.

1Inch is an excellent option for anyone who wants to take advantage of decentralized finance (DeFi) opportunities without the need to complete any KYC process.

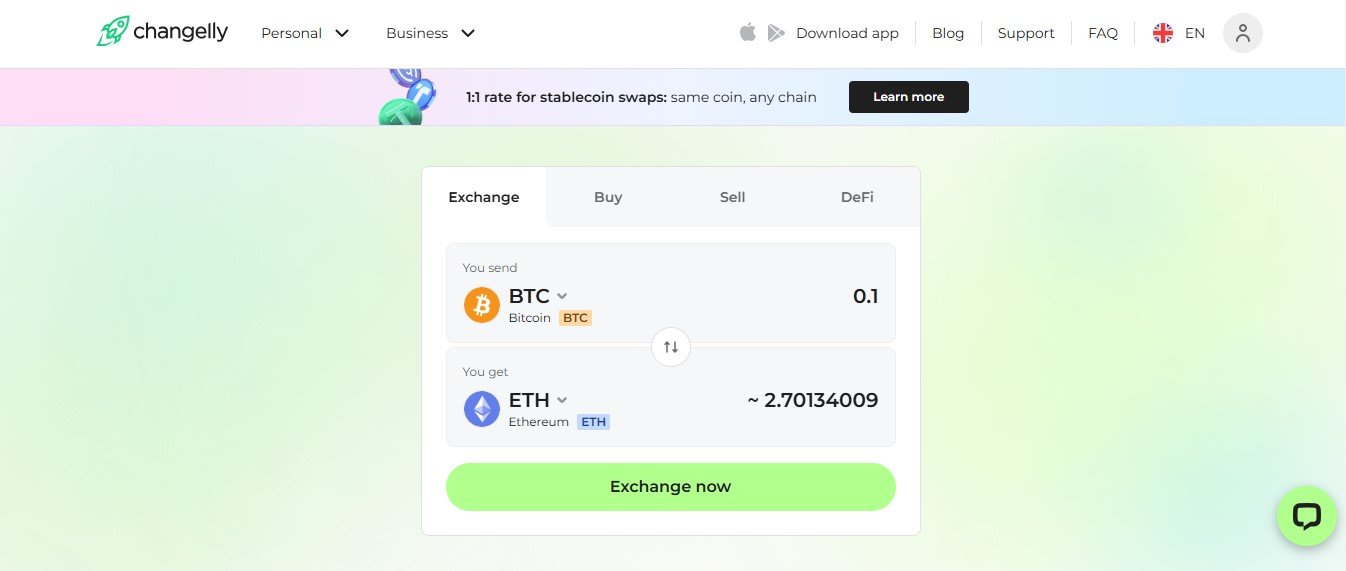

9. Changelly – Instant Crypto Swapping with Limited KYC Requirements

Changelly is a centralized crypto-swapping platform that allows users to quickly exchange cryptocurrencies without mandatory KYC or AML requirements for most transactions.

As of February 2024, Changelly may occasionally request certain users to complete a KYC check, which could take up to 24 hours. While it’s not fully KYC-free, this is only required for select transactions, so most users can swap crypto without ID verification.

Changelly also supports enhanced privacy features, allowing users to access the platform with a VPN for added security. This makes it a solid option for those looking to swap crypto with minimal hassle.

10. Thorswap – Cross-Chain Trading Without KYC

Thorswap operates on Thorchain, making it the world’s first multi-chain decentralized exchange (DEX) that facilitates seamless cross-chain swaps. This means you can easily exchange Bitcoin for Ethereum and other cryptocurrencies without needing permission or going through KYC processes.

With support for a variety of blockchain networks, Thorswap offers a unique trading experience, allowing users to transact freely across multiple chains. Since its rise in popularity during 2022-23, Thorswap has become a go-to platform for those seeking a no-KYC crypto exchange. If you’re looking for flexibility in trading different cryptocurrencies without the hassle of identity verification, Thorswap is worth exploring.

11. Bisq (formerly BitSquare) – Decentralized Peer-to-Peer Exchange

Bisq is a decentralized peer-to-peer marketplace that allows users to trade cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) without the need for any personal information, such as names or email addresses. This means there are no KYC or AML requirements, ensuring complete privacy for users.

To enhance security, Bisq operates over the Tor network, meaning it does not hold any fiat currencies or cryptocurrencies on its servers, making it a truly secure platform. Currently, Bisq supports trading for 126 different cryptocurrencies, including BTC, and is compatible with Windows, Mac, and Linux operating systems.

While the trading volume on Bisq is relatively low, with around 50 BTC traded daily as of February 1, 2024, it remains an excellent option for those seeking a no-KYC Bitcoin peer-to-peer exchange that prioritizes user privacy and control.

12. Bybit—Previously No-KYC Trading Platform

Bybit is a well-known cryptocurrency exchange that offers both spot and derivative trading. However, it’s important to note that KYC became mandatory in June 2023. Before that, Bybit allowed users to trade various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP, EOS, SUSHI, AAVE, and USDT without undergoing identity verification.

Here are some of the key features of Bybit:

- Spot Trading: Buy and sell cryptocurrencies at current market prices.

- Margin Trading: Trade with leverage to maximize potential returns.

- Earn Program: Generate yield on your chosen cryptocurrencies.

- Perpetual Trading: Engage in trades without expiration dates.

- MetaTrader 4 Integration: Access advanced trading tools and analysis.

- Crypto Loans: Borrow against your crypto holdings for added flexibility.

Bybit also hosts various trading competitions, providing opportunities for traders to showcase their skills and earn rewards.

As of now, Bybit requires users to complete KYC to withdraw funds, with a daily withdrawal limit of 20,000 USDT and a monthly limit of 100,000 USDT. Despite the KYC requirement, it remains a popular choice for those looking to engage in cryptocurrency trading.

Conclusion-No-KYC Crypto Exchanges in 2024

The demand for no-KYC (Know Your Customer) and AML (Anti-Money Laundering) exchanges has been steadily rising as decentralized finance (DeFi) platforms expand. Decentralized exchanges (DEXs) are introducing innovative solutions to bypass traditional verification requirements, putting pressure on centralized exchanges to reconsider their KYC practices to stay competitive.

Can You Buy Crypto Without KYC?

Yes, it is possible to buy crypto without undergoing KYC. For users seeking greater anonymity, permissionless swaps or peer-to-peer (P2P) exchanges are often the best solutions. These platforms allow buyers and sellers to transact directly without intermediary verification. This route is especially appealing for newcomers looking to enter the crypto world while preserving their privacy.

How to Buy USDT Without KYC

In 2024, most non-KYC exchanges require basic verification for certain transactions. However, one of the easiest methods to buy USDT without KYC is through cash-based P2P platforms. If you’re in a region where cash-crypto transactions are legally permissible, you can seek out a peer willing to exchange USDT for cash. Platforms like Rango.exchange can then be used to swap various cryptocurrencies into USDT, providing a flexible option for non-KYC transactions.

What is the Best Crypto Trading App with No KYC?

If you’re not concerned about high withdrawal limits, platforms like Phemex offer trading with no KYC, allowing users to trade up to 50,000 USDT daily without verification. This option is suitable for small-volume traders seeking flexibility and privacy, as the platform provides ample limits for typical retail trading needs.

Should You Use DEXs Over Centralized Exchanges for No-KYC Trading?

Layer 2 DEXs, such as GMX and dydx, present new options for day traders without requiring KYC. However, DEXs often come with higher fees, particularly on networks like Ethereum, where gas fees can deter smaller trades. In such cases, users can explore non-KYC centralized exchanges to benefit from lower fees while still avoiding comprehensive identity verification. For long-term holding and privacy, DEXs remain a viable alternative.

What are the KYC Limits on Changelly?

Changelly imposes certain transaction limits without requiring KYC: up to $20,000 daily and $50,000 monthly. These limits encompass all transaction fees, making it a convenient choice for users who value privacy yet require relatively high trading limits.

Does Metamask Require KYC?

No, Metamask does not require KYC for its core functionality. As a decentralized wallet, it operates without personal identity verification, making it a popular choice for privacy-conscious users and those interacting with DeFi platforms.

Best No-KYC Bitcoin Exchanges

For users looking to buy Bitcoin without KYC, platforms like Phemex and MEXC offer low-barrier options. Small transactions are possible without verification; however, adding funds through traditional bank processors may still trigger ID checks from banking partners. Staying informed about these conditions can help users make more private financial decisions.

Can You Withdraw from KuCoin Without KYC?

KuCoin recently introduced mandatory KYC for users, although some withdrawal features remain available for unverified accounts. Users should be aware that their withdrawal limits may be lower without verification, so KuCoin is now better suited to those who are comfortable with at least partial KYC.

Why Do Traders Prefer No-KYC Exchanges?

Many crypto enthusiasts opt for no-KYC exchanges due to privacy concerns. Sharing personal data with third-party platforms is undesirable for many, especially those in regions with restrictive regulations. Additionally, no-KYC platforms allow users to manage assets discreetly, maintaining confidentiality from creditors, employers, or others. Moreover, AML and KYC policies often go against the decentralized nature of cryptocurrencies, driving demand for platforms that align with the principles of privacy and autonomy.

Future of Non-KYC Exchanges: Privacy and Legal Implications

As DeFi grows, the options for no-KYC trading will likely expand alongside it. However, while these platforms emphasize privacy, users should be cautious of legal ramifications, as some jurisdictions impose penalties for using anonymous platforms. Regulations are also evolving, which means many non-KYC exchanges might eventually adopt stricter compliance standards.

Here at Xcryptonic, we strive to keep an updated list of reputable non-KYC exchanges, and we track regulatory changes that might impact user choices. Note that none of these platforms are intended for illicit activities like money laundering, and misuse could result in serious legal consequences depending on your region.

That’s it from us—now we’d love to hear from you. If you’re aware of altcoin and crypto platforms that bypass KYC and AML, share them in the comments!